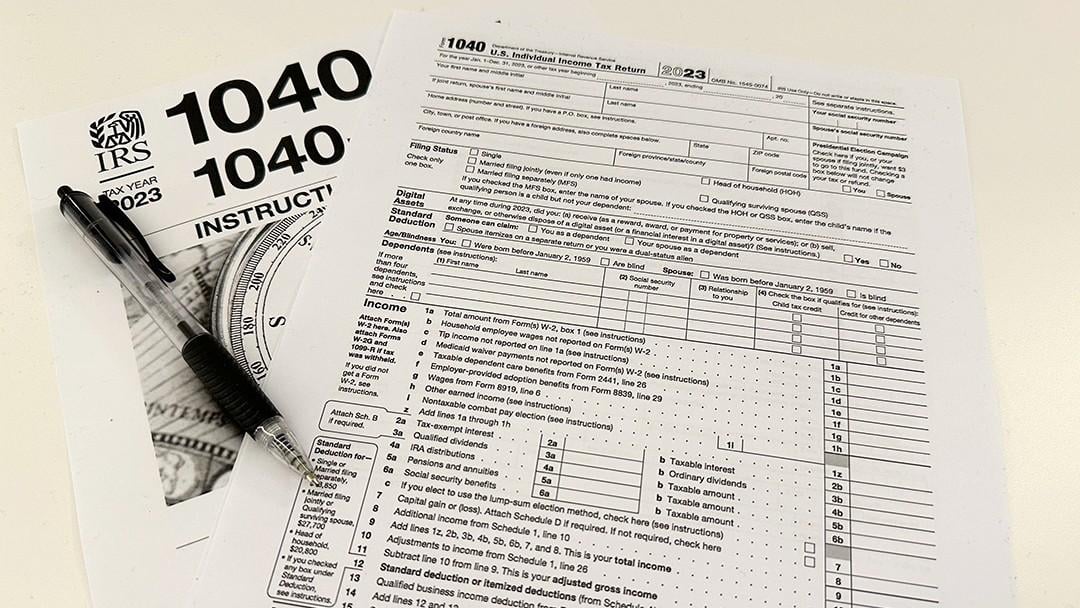

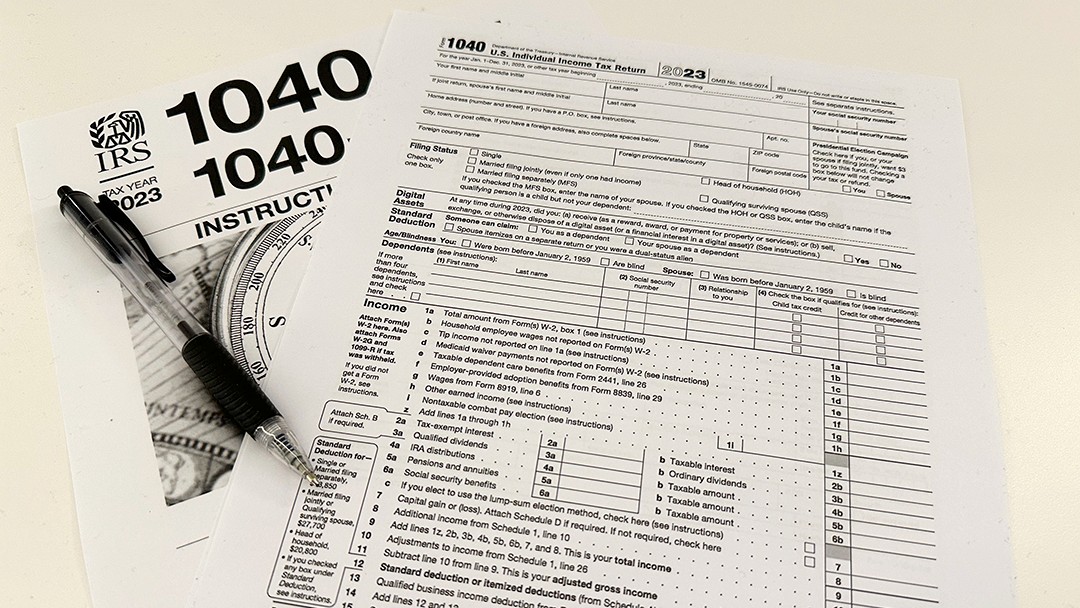

Irs 2024 Schedule 4 Instructions Meaning – For more tax tips, check out our tax filing cheat sheet and the top tax software for 2024 4. You claim too many business expenses or losses You’re required to file a Schedule C form if . For 2023, the $600 threshold is delayed the companies to report payments on 1099-Ks and a $5,000 threshold is planned for 2024 Received.” Internal Revenue Service. “Instructions for Forms .

Irs 2024 Schedule 4 Instructions Meaning

Source : news.wttw.com1040 (2023) | Internal Revenue Service

Source : www.irs.govTax Season is Under Way. Here Are Some Tips to Navigate It

Source : news.wttw.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comThe Wall Street Journal on LinkedIn: What the 2024 Capital Gains

Source : www.linkedin.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govCommunicate with your tax advisor for your New Year’s resolutions

Source : www.linkedin.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 Instructions for Schedule C

Source : www.irs.govIrs 2024 Schedule 4 Instructions Meaning Tax Season is Under Way. Here Are Some Tips to Navigate It : Ad Valorem Tax Property taxes are an ad valorem tax, meaning the tax is based Mortgage Interest Statement.” Page 4. Internal Revenue Service. “General Instructions for Certain Information . The surviving spouse can also submit a new RMD schedule based on their life expectancy. This process would mean applying Pages 4, 10. Internal Revenue Service. “Instructions for Schedule .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)