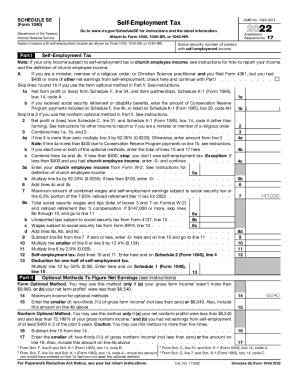

2024 Schedule Se Form 1040 Instructions – The Internal Revenue Service (IRS) has released updated Schedule SE tax form and instructions for the tax years 2023 and 2024. TRAVERSE CITY, MI, US, January 12, 2024 /EINPresswire / — The . It is best to check your income tax booklet instructions Fill out Schedule SE for self-employment taxes if you earned at least $400, according to the IRS. Use the formulas on the form to .

2024 Schedule Se Form 1040 Instructions

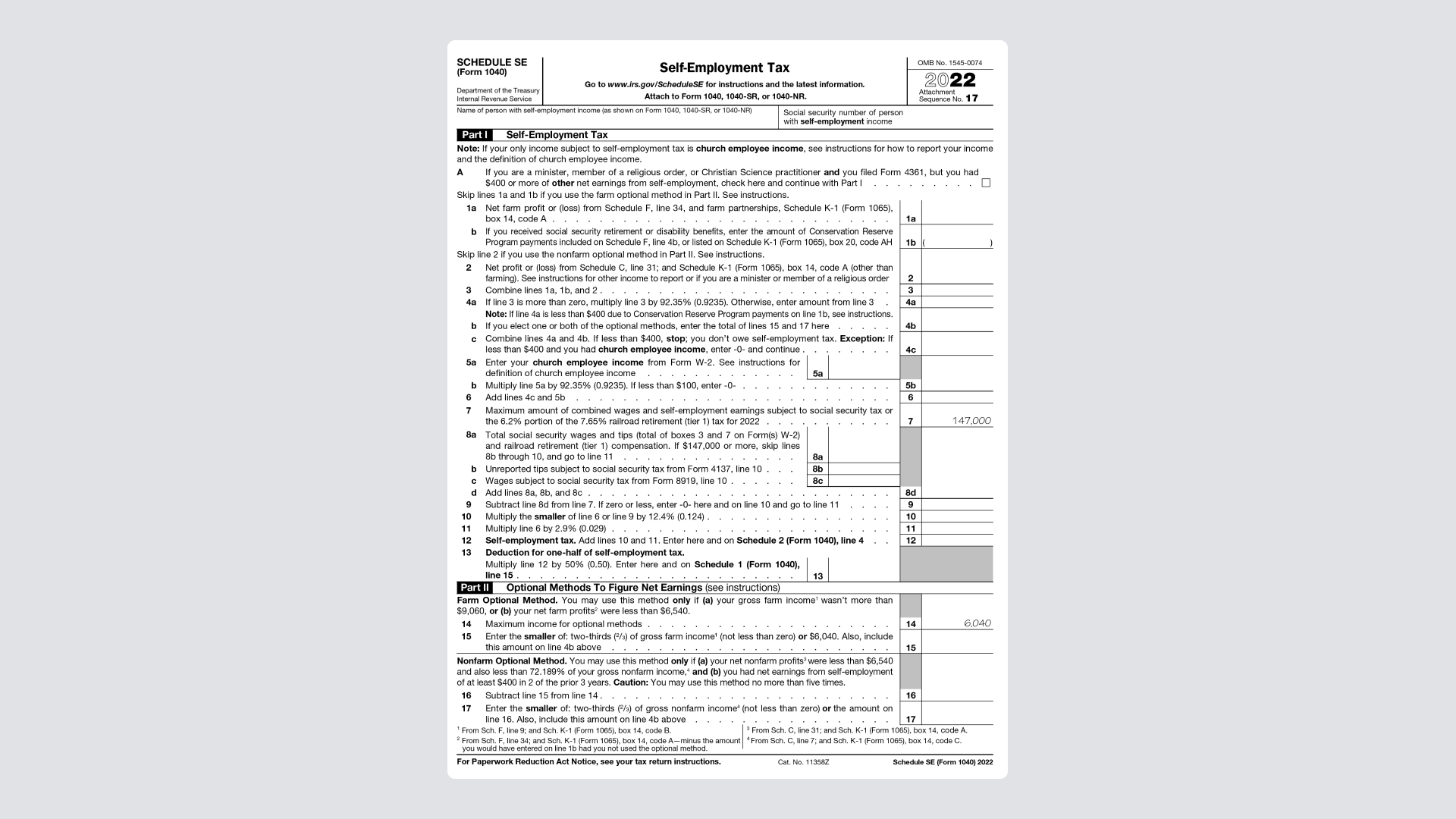

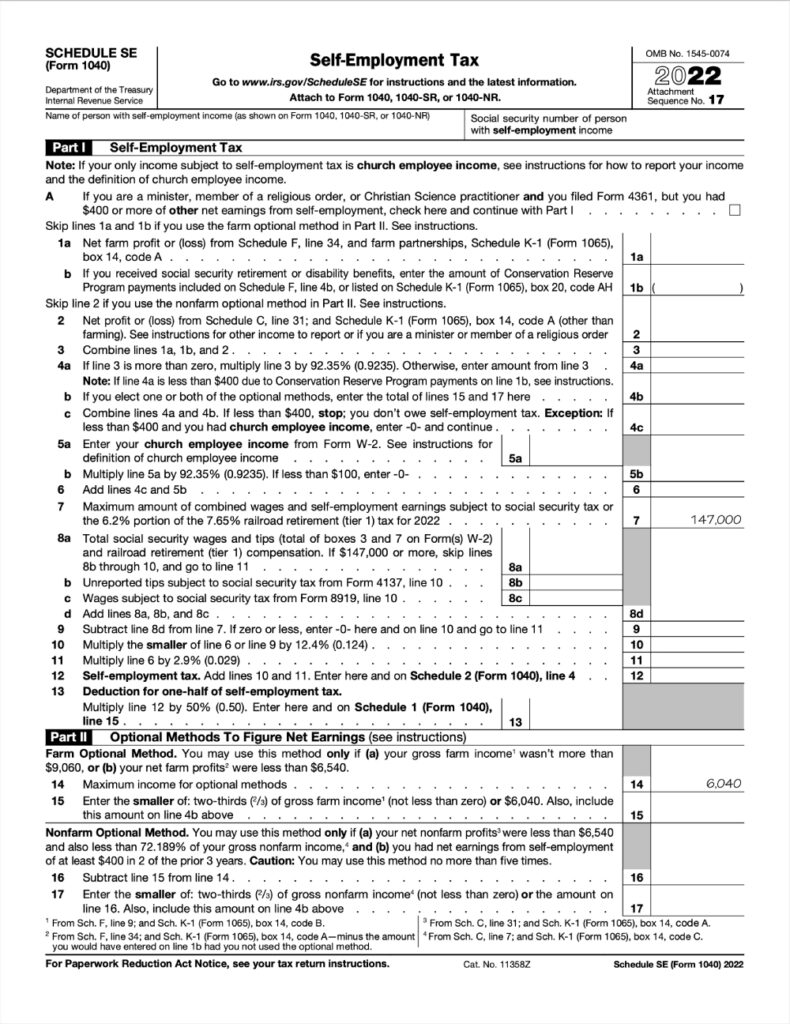

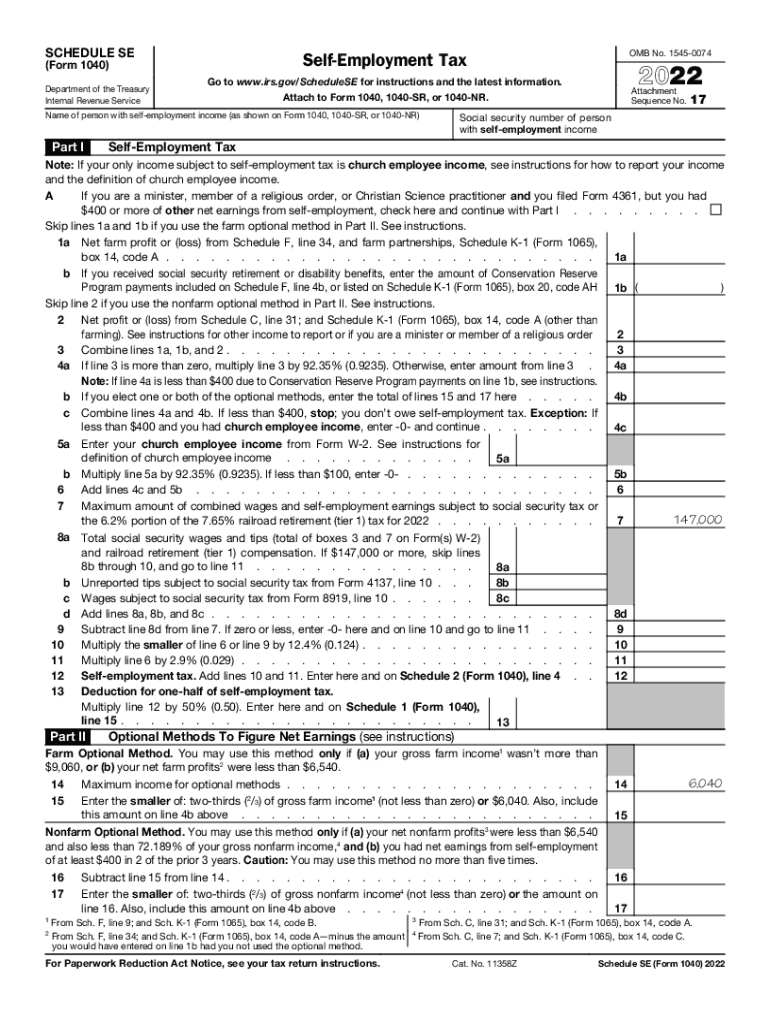

Source : tax-form-1040-instructions.pdffiller.comA Step by Step Guide to the Schedule SE Tax Form

Source : found.comIRS Instruction 1040 Schedule SE 2022 2024 Fill and Sign

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Schedule SE (1040 form) | pdfFiller

Source : www.pdffiller.comSchedule SE: Filing Instructions for the Self Employment Tax Form

Source : lili.coSelf employed taxes 2022: Fill out & sign online | DocHub

Source : www.dochub.comAbout Schedule SE (Form 1040), Self Employment Tax | Internal

Source : www.irs.govSchedule se 2017: Fill out & sign online | DocHub

Source : www.dochub.comSelf 2022 2024 Form Fill Out and Sign Printable PDF Template

Source : www.signnow.com2024 Schedule Se Form 1040 Instructions 2023 Form IRS Instruction 1040 Schedule SE Fill Online : These taxes are calculated using Schedule SE with your Form 1040 tax return For more on qualifying as an S-corp, see the instructions to Form 2553. A C corporation is a separate legal entity . What else do you need to know about being a gig worker and taxes? You will use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. And, you may have to make .

]]>